Couch Potato Portfolio 2019

:max_bytes(150000):strip_icc()/GettyImages-1164679710-1ff1c0da416c4777992f1631551550d8.jpg)

If you can fog a mirror and divide by the number 2 or make a margarita he ll show you how to get better investment results and a better retirement with little or no effort.

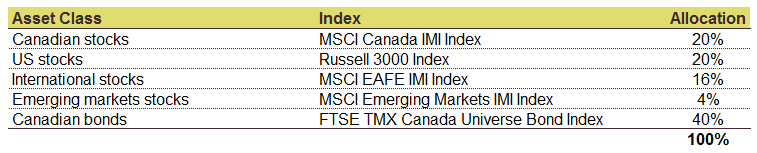

Couch potato portfolio 2019. Conservative investors should allocate more. Couch potato portfolio. Model portfolios canadian couch potato 2020 09 02t11 49 10 04 00. Read couch potato portfolio.

I cooked for my younger brothers when i was a kid. As of october 2019 the s p is up 19 92 while the couch potato is cooking at. We show you what etfs and funds to buy. By scott burns september 12 2018.

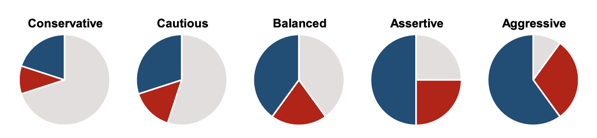

They are medium risk and low risk portfolios. The scott burns couch potato portfolio is exposed for 50 on the stock market. By scott burns january 18 2020. The following model portfolios can help you get started as a couch potato investor.

How to set it up. By scott burns april 11 2020. The couch potato portfolio can be built with 2 etfs. The suggestions below include portfolios built from etfs and index mutual funds.

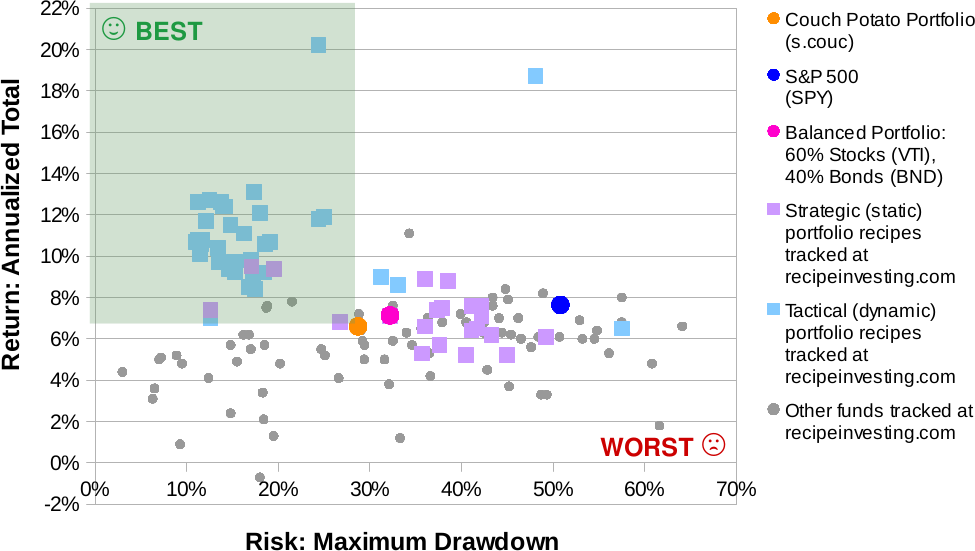

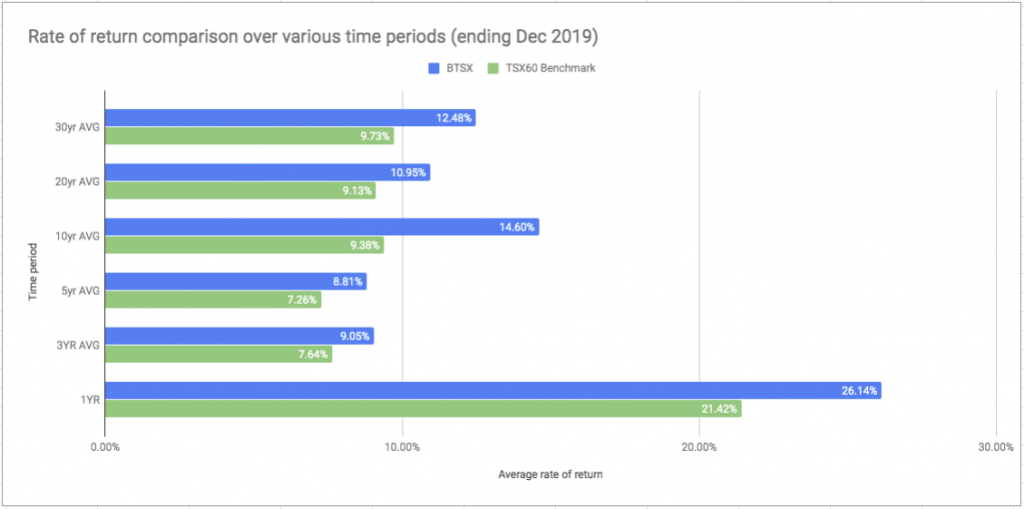

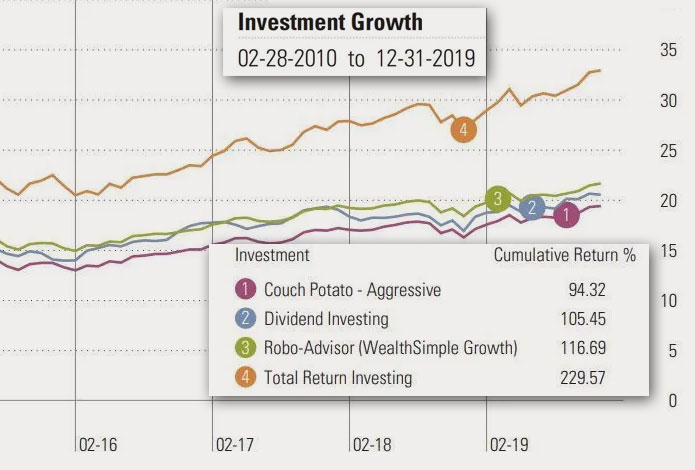

Start with a plan. Couch potato investing cp portfolio recipes income wealth. For the past 10 years the couch potato portfolio has returned 8 56 with a standard deviation of 9 86. And both portfolios recovered after the financial crisis in 2008.

The portfolio is exposed to 50 bonds and 50 equities. Scott burns is the creator of couch potato investing and a personal finance columnist with decades of experience. The trouble with stock prices. Let s hear it for sloth and simplicity.

Both options include several asset mixes. It is a medium risk portfolio. Remain calm and carry on vc row by scott burns march 1 2020. They are is exposed to between 20 to 80 equities and 20 to 80 bonds including tips.

Like the couch potato portfolio the first thing to notice is that every finishing portfolio value is greater than the original 100 000 investment. Couch potato investing income wealth. Looking at the 10 year period 2010 2019 the s p 500 has returned 12 97 and the couch potato portfolio 8 48. Both portfolios declined in value for three years in 2000 2001 and 2002.

Both portfolios suffered in the same years. How to build the basic couch potato portfolio anywhere for next to nothing. In the last 10 years the portfolio obtained a 9 41 compound annual return with a 7 45 standard deviation. By scott burns march 15 2019.

You should choose the one best suited to your risk profile. Couch potato investing cp portfolio recipes. Couch potato investing. It s a medium risk portfolio and it can be replicated with 2 etfs.

Want to eliminate the employment tax. I like to cook. Should you take. In 2019 the portfolio granted a 2 09 dividend yield.

Are you broke yet.